7 Good Money Habits That Make You Wealthy in 2025

Good money habits are what set successful people apart in 2025. They aren’t just lucky or born into wealth—they’ve built financial discipline through real-life behavior. In this article, we’ll walk through seven money habits that people use to stay out of debt, build wealth, and live with financial peace.

1. They Live Below Their Means

One of the most foundational money habits is spending less than you earn. People who are great with money don’t chase lifestyle upgrades every time their income increases. Instead, they:

- Track their spending monthly

- Avoid emotional purchases

- Stick to a monthly spending cap

Example: If someone earns $4,000/month, they live on $2,800–$3,200 and save or invest the rest. That consistent difference becomes the fuel for investing, debt reduction, and long-term security.

This habit also makes room for flexibility in emergencies or career shifts. Living below your means means freedom—not sacrifice.

2. They Set Clear Financial Goals

Setting goals gives money direction. Without a goal, your money will drift toward unnecessary expenses and impulse buys. Financially smart people define short-term and long-term goals, such as:

- Save $1,000 for an emergency fund in 90 days

- Pay off a $5,000 credit card within 6 months

- Invest $200/month for retirement consistently

These goals give each dollar a job. When you wake up every morning with a goal in mind, your financial decisions become sharper. You’re more likely to cook at home, cancel unused subscriptions, and avoid swiping that credit card out of boredom.

Financial goals also help couples and families work as a team, keeping priorities aligned and communication clear.

3. They Automate Their Savings

One powerful way to make saving consistent is automation. Smart savers don’t rely on memory or motivation. They set up:

- Automatic transfers from checking to savings every payday

- Recurring investments to Roth IRA or brokerage accounts

- Separate savings buckets for different goals: vacation, emergency, car repairs

This removes friction and ensures money is saved before it’s spent. It’s a psychological advantage—once the money leaves your checking account automatically, you no longer “see it” as spendable cash.

This habit is the secret weapon of consistent savers in 2025. With tools like Ally Bank, Capital One 360, or apps like Qapital, setting and forgetting your savings is easier than ever.

4. They Educate Themselves About Finances

Money-smart people treat financial literacy as an ongoing process. They read books, listen to podcasts, and follow credible finance blogs like Budlx. Great habits include:

- Reading one finance book per quarter

- Listening to finance podcasts during commutes

- Following updates on tax law and interest rates

Knowledge is power in the world of money. Understanding compound interest, inflation, and budgeting gives you an edge that most people never develop. Learning to recognize financial red flags helps you avoid scams, debt traps, and poor investment decisions.

5. They Avoid Bad Debt

Not all debt is created equal. Wealthy and financially stable people know the difference. They avoid bad debt like:

- High-interest credit card balances

- Payday loans or “quick cash” schemes

- Buy-now-pay-later traps

Instead, they only take on debt when it serves a long-term purpose, such as a mortgage or student loan for a high-ROI degree. Before borrowing, they ask:

“Will this debt improve my financial future, or will it drag me down?”

This habit builds a solid financial foundation. Avoiding bad debt is often more powerful than earning more money—because interest compounds both ways.

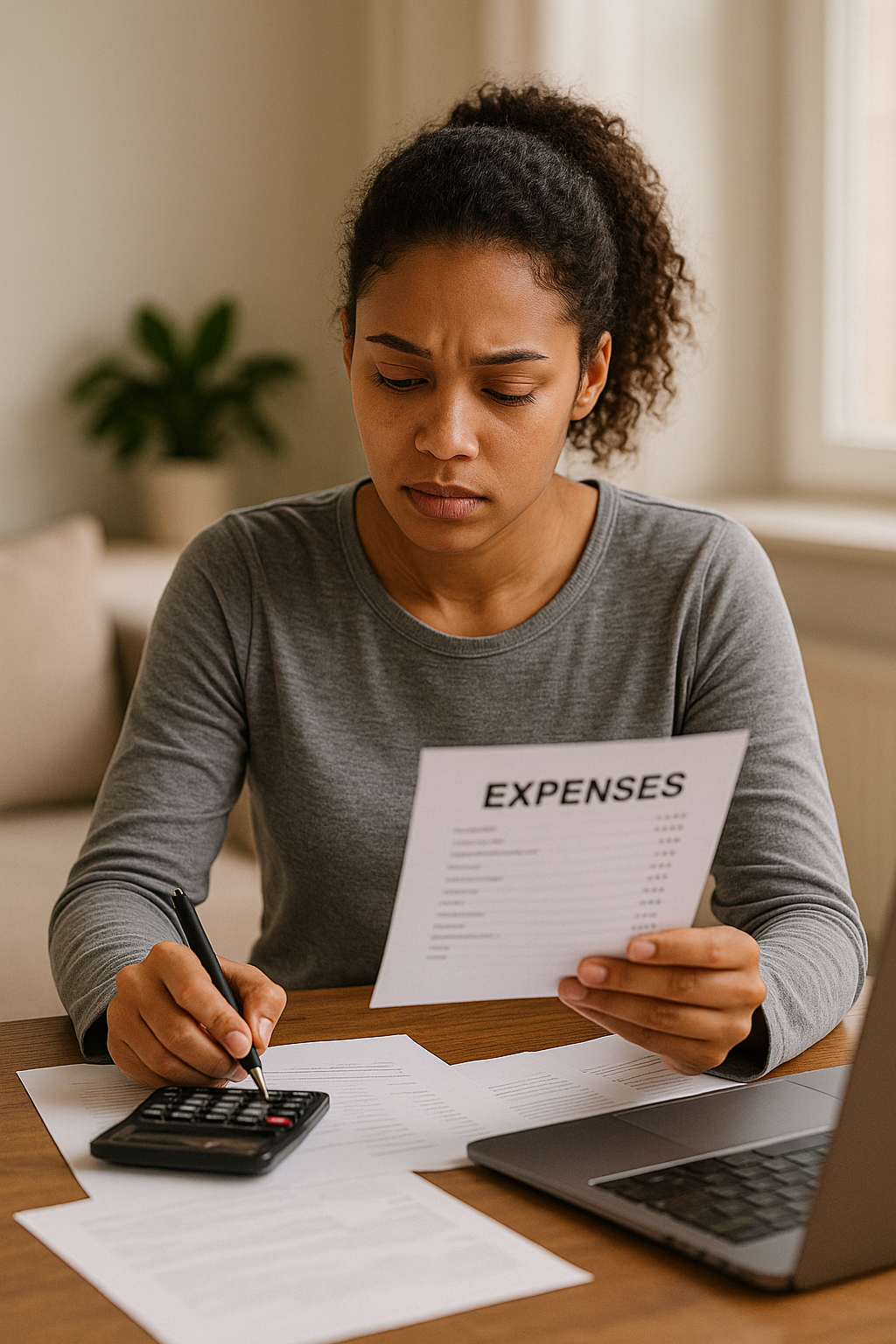

6. They Track Their Spending

Tracking expenses reveals leaks. People who manage money well use:

- Apps like Mint, YNAB (You Need a Budget), or Spendee

- Manual spreadsheets for detailed tracking

- Weekly spending reviews as a routine check-in

This creates awareness and accountability—two essential ingredients for lasting financial change. It’s not about being restrictive, it’s about being intentional. When you know where every dollar goes, you start aligning spending with your values.

7. They Invest Consistently

Rather than trying to time the market, they invest small amounts regularly (dollar-cost averaging). They:

- Use index funds like VTI, SPY, or QQQ

- Invest in retirement accounts like 401(k), Roth IRA, or SEP IRA

- Avoid gambling on meme stocks or crypto without clear strategy

Consistency beats timing. For example, investing $200/month for 10 years at an 8% return grows to nearly $37,000. Add another 10 years and it becomes $110,000+. That’s the power of compounding and long-term thinking.

Bonus: They Talk About Money with Confidence

Whether it’s with their spouse, kids, or advisor, they openly discuss:

- Financial goals and fears

- Investment plans and timelines

- Spending priorities and lifestyle choices

This breaks money taboos and builds alignment in families and partnerships. Money becomes less of a stressor and more of a shared tool for building the future.

How to Reinforce Habits Over the Next 30 Days

Building habits is one thing, reinforcing them is another. Over the next 30 days, here’s a step-by-step system to make these habits stick:

- Day 1–3: Pick just ONE habit to focus on. Write down your reason and track your baseline.

- Day 4–10: Create friction for bad habits. For example, delete shopping apps, freeze credit cards, unsubscribe from sales emails.

- Day 11–15: Build triggers. Pair your habit with another routine. For example, review your budget right after brushing your teeth.

- Day 16–20: Reward yourself with small wins. For every week of sticking to your budget, allow a $10 treat or a rest day.

- Day 21–30: Reflect, adjust, and double down. Journal your progress, tweak what didn’t work, and plan the next month in advance.

By taking this structured approach, you’re no longer relying on willpower—you’re building systems that support your goals.

Final Thoughts

Building wealth isn’t about luck—it’s about habits. These 7 good money habits will help you stay in control of your finances in 2025 and beyond.

Start with one habit. Master it. Then build another. The momentum will carry you toward long-term financial freedom.

Common Mistakes to Avoid While Building Money Habits

Building money habits takes time—and avoiding the wrong moves is just as important as doing the right ones. Here are common traps that sabotage progress:

- Trying to do too much at once: If you attempt to track every penny, cut all spending, start investing, and pay off debt all in one week, you’ll burn out. Focus on one habit at a time.

- Comparing yourself to others: Financial journeys are unique. Social media might show someone investing $2,000/month, but your $50 habit is just as powerful when done consistently.

- Skipping an emergency fund: Many people jump straight to investing or debt payoff without a basic safety net. This leads to setbacks the moment an unexpected bill appears.

- Not tracking progress: Without regular check-ins, it’s hard to see how far you’ve come. That can lead to discouragement and quitting early.

Avoiding these mistakes helps you build money habits that last. The goal isn’t perfection—it’s progress with purpose.